Let’s discussed ways to calculate GST on Mobile Phones. It’s a bright Saturday morning and Aditi walks into an electronics store in Pune, planning to upgrade her three-year-old smartphone.

She checks the price tag: ₹24,999. But when the cashier prints the bill, it reads ₹29,499. The difference? GST on Mobile Phones – the Goods and Services Tax that silently adds 18 percent to almost every device you buy in India.

Since GST replaced VAT and excise duties in 2017, it has transformed how electronics are priced, sold, imported, and accounted for. Whether you’re a consumer comparing online deals or a retailer filing returns, understanding GST on Mobile Phones helps you decode that extra line on the invoice and plan smarter.

Calculate GST at: https://mygstcalculator.com/

What Is GST on Mobile Phones and Why It Matters

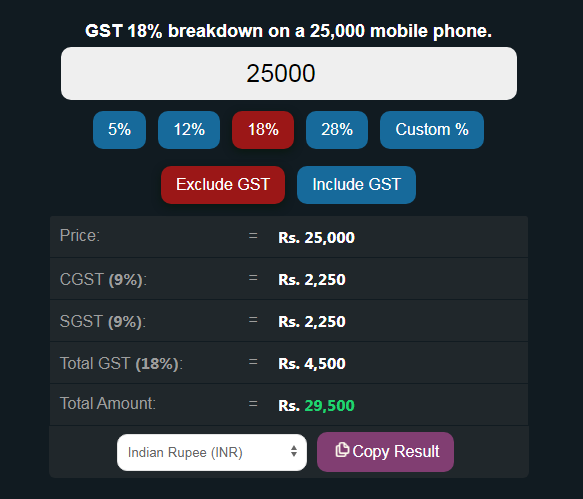

GST on Mobile Phones is an indirect tax applied on the supply of mobile devices – both domestic and imported. The rate currently stands at 18%, split as 9% CGST + 9% SGST for intra-state sales or as 18% IGST for inter-state and import transactions.

Key objectives of GST for electronics:

- Create a uniform tax structure across India.

- Eliminate the “tax-on-tax” effect of VAT + excise.

- Simplify credit claims for businesses.

- Bring transparency to pricing for consumers.

Before 2017, mobiles faced multiple state taxes (about 25–27%). Today, the 18% GST is consistent nationwide – making invoicing and returns far simpler.

Historical Shift – From VAT to GST on Mobile Phones

| Period | Tax System | Approx. Rate | Effect on Prices |

|---|---|---|---|

| Pre-2017 | VAT + Excise | ≈25% | High and non-uniform |

| 2017 | GST Introduced | 12% | Prices slightly lower |

| 2020 | Rate Revised | 18% | Moderate price increase |

| 2025 | Current | 18% | Stable but transparent |

Manufacturers argued the 12% slab caused input-credit accumulation for component makers; hence the move to 18%. While it raised the sticker price, it smoothed supply-chain tax credits.

Current GST Rates on Mobiles and Accessories

| Category | GST Rate | Notes |

|---|---|---|

| Smartphones (all brands) | 18% | Uniform rate |

| Feature phones | 18% | Same as smartphones |

| Chargers & Cables | 18% | Accessory category |

| Earphones / Headphones | 18% | Wired & Bluetooth |

| Covers, Screen Guards | 18% | Retail accessories |

The rate applies to both online and offline sales. Retailers must show the tax component clearly on the invoice.

Exclusive vs Inclusive Pricing (How to Read Your Invoice)

Exclusive Pricing

Base ₹20,000 → GST 18% ₹3,600 → Final ₹23,600

Inclusive Pricing

Listed ₹23,600 (inclusive) → Base = ₹23,600 × 100 / 118 = ₹20,000 → GST ₹3,600

Formula check:

GST component (inclusive price) = Total × Rate / (100 + Rate)

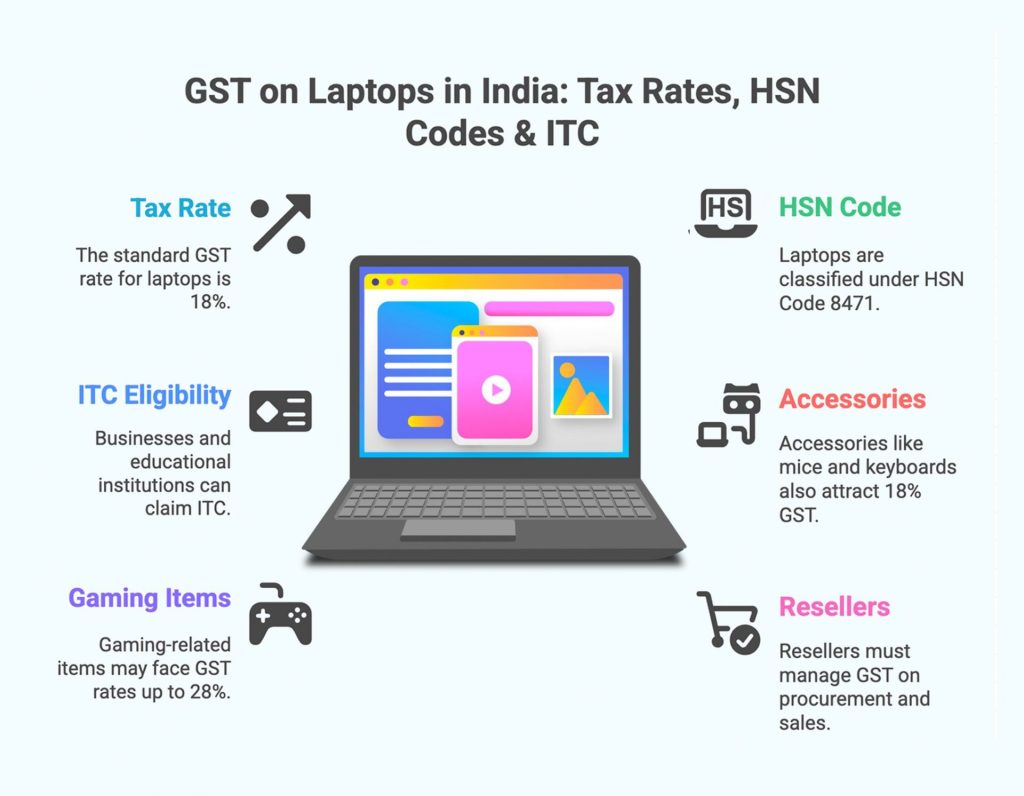

GST on Laptops and Other Electronics

Although the focus is GST on Mobile Phones, consumers often compare phones with laptops and tablets – all taxed at 18%.

| Item | GST Rate | Remarks |

|---|---|---|

| Laptops / Desktops | 18% | Standard rate |

| Monitors / Keyboards / Mice | 18% | Peripherals |

| Pre-installed OS Software | 18% | Bundled product |

| Standalone Software Licenses | 18% | IT service category |

Import Scenario – How IGST Shapes Final Cost

Imagine you import an iPhone from Singapore:

- CIF Value ₹80,000

- Customs Duty 20% = ₹16,000

- Assessable ₹96,000

- IGST 18% = ₹17,280

- Landed Cost = ₹1,13,280

Distributors then add margins and logistics, bringing the MRP close to ₹1,29,900. That’s how GST on Mobile Phones affects imported pricing.

Impact of GST on Mobile Phones for Consumers

- Uniform nationwide rate means price consistency across states.

- Transparent billing shows base + tax clearly.

- Affordability impacted in budget segment because of 18% slab.

- Premium phones see less impact as buyers are less price-sensitive.

| Year | Avg Price | GST Rate | Trend |

|---|---|---|---|

| 2016 | ₹12,500 | VAT ≈14% | Stable |

| 2017 | ₹13,000 | 12% | Minor dip |

| 2020 | ₹15,500 | 18% | Increase |

| 2025 | ₹20,000+ | 18% | Premium growth |

Business Perspective – Claiming Input Tax Credit (ITC)

Businesses buying mobiles for official use can claim ITC on GST on Mobile Phones.

Steps to claim:

- Ensure supplier GSTIN appears on invoice.

- Invoice must reflect in your GSTR-2B.

- Claim credit in GSTR-3B for the month.

- Keep asset register and usage records.

Example: Company purchases 10 phones for ₹1,00,000 + ₹18,000 GST → ₹18,000 ITC offset against output tax.

E-Commerce and Marketplaces

Platforms like Amazon and Flipkart charge GST on Mobile Phones at checkout and remit it to sellers. For registered sellers:

- Invoices must display GST clearly.

- Commission charges from platforms include their own 18% GST.

- TCS (1%) is collected and reflected in Form 26AS for reconciliation.

Discounts and Exchange Schemes

Pre-tax discounts → GST on reduced value.

Post-tax discounts → No GST change on main invoice.

Example: ₹20,000 phone with 10% discount → ₹18,000 taxable → GST ₹3,240 → Total ₹21,240.

Trade-in values reduce the taxable base if documented properly.

Second-Hand Phones and RCM

Resellers of used phones may use margin schemes: GST applies only on profit margin, not full sale value. RCM rarely applies but check notifications for specific cases like imports of services.

Fraud Prevention – Verify GSTIN on Mobile Sellers

Avoid fake invoices by checking GST numbers on the official GST portal. If the seller is not registered, you can’t legally claim ITC on the GST you paid.

Future of GST on Mobile Phones (2025 and Beyond)

- Industry bodies request 12% for budget devices.

- GST Council review expected in late 2025.

- E-invoicing will auto-link retail purchases to GSTR-2B.

- AI tools will detect mismatch in tax credits.

- Green policy may reward recycling of electronics.

FAQs – Everything about GST on Mobile Phones

What is the current GST rate on mobile phones?

18% across India – this is the standard GST on Mobile Phones.

Can businesses claim ITC on mobiles used by staff?

Yes, if used for taxable business activities and properly invoiced.

How does GST on Mobile Phones affect imported devices?

Imports attract 18% IGST plus customs duty.

Are accessories taxed differently?

No, most common accessories are also 18%.

Will the rate change soon?

Possible review under Digital India initiatives, but no official notification yet.

Conclusion

Understanding GST on Mobile Phones helps both buyers and sellers make informed decisions. For consumers, it means transparent pricing and awareness of tax break-up. For businesses, it means better cash-flow planning through input credits and compliance.

Next time you see a price tag, remember that the 18% line is not just a tax — it’s the engine driving India’s simplified tax system.