Discover how GST for small businesses can manage easily. Learn registration, filing, Suvidha Centers, composition scheme, and cost-saving strategies for small enterprises.

Meet Neha — she runs a small handmade soap business from her home in Jaipur. Her online sales are growing, and she recently received her first bulk order from a corporate client.

Excited, she’s about to send her invoice when the buyer asks:

“Do you have a GST number?”

For Neha, like thousands of small business owners in India, that one question opens the door to a world of formal business compliance, tax benefits, and new opportunities.

But it also raises questions:

- When exactly do I need GST registration?

- What are the costs involved?

- How do I file GST returns without hiring an accountant?

In this blog, we’ll explore everything small business owners need to know about GST in 2025 — explained in simple language with real-life context, tips, and online tools.

Let’s dive in.

1. What Is and Why It Matters GST for Small Businesses

Goods and Services Tax (GST) is India’s unified indirect tax that replaced multiple old taxes like VAT, excise, and service tax.

For small businesses, it’s more than a compliance requirement — it’s a gateway to growth.

💡 Why Small Businesses Should Care:

- Registering under GST gives your business legitimacy and builds customer trust.

- It allows you to claim Input Tax Credit (ITC) on purchases.

- It’s mandatory for interstate or e-commerce sales.

- It simplifies bookkeeping and enables easier access to loans.

In short, GST helps your small business operate on equal footing with larger enterprises.

2. When Does a Small Business Need GST Registration?

Let’s clarify one of the biggest questions small business owners have: “Do I need to register for GST?”

📊 Mandatory Registration

You must register if your:

- Annual turnover exceeds ₹40 lakhs (for goods) or ₹20 lakhs (for services).

- You sell products or services across state borders.

- You sell through online platforms like Amazon, Meesho, or Flipkart.

- You operate as an agent or distributor.

💡 Voluntary Registration

Even if you’re under the threshold, registering voluntarily gives you:

- The ability to claim Input Tax Credit.

- The image of a trustworthy vendor.

- Eligibility to deal with corporate clients and government tenders.

🧾 Registration Cost

- Official GST registration is free on gst.gov.in.

- If you hire a consultant or visit a GST Suvidha Center, they may charge ₹500–₹1,000 for assistance.

3. Step-by-Step GST Registration for Proprietors

If you’re a sole proprietor or small trader, registering is straightforward.

✅ Steps:

- Visit gst.gov.in.

- Select Services → Registration → New Registration.

- Enter PAN, state, email, and mobile number.

- Verify OTP → Get Temporary Reference Number (TRN).

- Upload documents: PAN, Aadhaar, business address proof, bank details.

- Submit with EVC (OTP verification).

- Receive your 15-digit GSTIN in 3–5 days.

🧾 Required Documents:

- PAN and Aadhaar of proprietor

- Business address proof (rent agreement, electricity bill, etc.)

- Bank statement or canceled cheque

- Passport-size photo

4. How to File GST Returns as a Small Business

Once you’re registered, the next big task is filing GST returns — basically, reporting your sales and tax payments to the government.

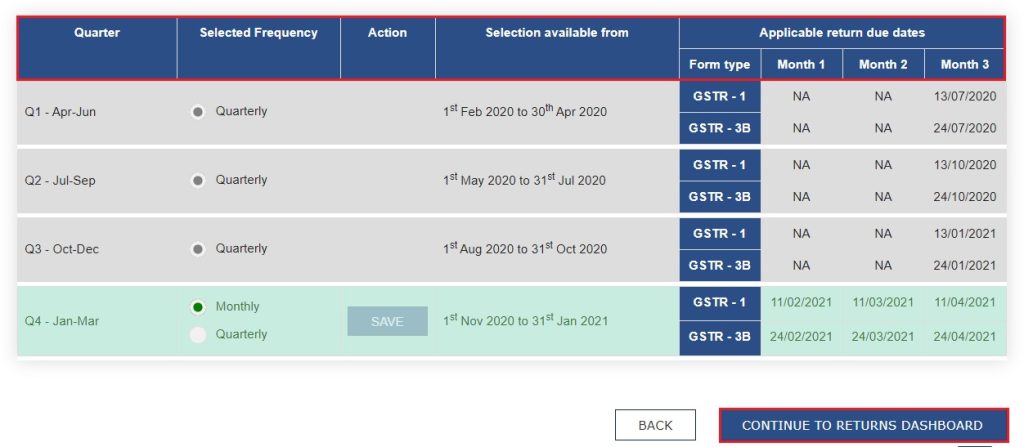

📘 Common Return Forms

| Form | Frequency | Purpose |

|---|---|---|

| GSTR-1 | Monthly/Quarterly | Sales details |

| GSTR-3B | Monthly | Summary return with tax payment |

| GSTR-9 | Annually | Annual summary of all returns |

💻 Filing Methods

- Through GST Portal: Log in → Services → Returns → File Returns.

- Through GST Suvidha Providers (GSPs): Platforms like ClearTax, Tally, and Zoho Books simplify the process.

- Through Suvidha Centers: Offline help centers for non-tech users.

💡 Pro Tips for Small Businesses

- Always file before the due date to avoid penalties.

- Keep sales and purchase records updated.

- Reconcile your GSTR-2B (purchases) with supplier invoices monthly.

5. GST Composition Scheme — Simplified Tax for Small Enterprises

If you’re a small business with turnover under ₹1.5 crore, the Composition Scheme is your best friend.

⚙️ What It Means

Instead of filing monthly returns, you pay a fixed percentage of turnover as tax, and file only once per quarter.

📊 Composition Scheme Rates

| Business Type | GST Rate | Filing Frequency |

|---|---|---|

| Manufacturers | 1% | Quarterly |

| Traders | 1% | Quarterly |

| Restaurants | 5% | Quarterly |

💡 Benefits:

- Less paperwork

- Lower tax liability

- Simpler record-keeping

⚠️ Limitations:

- Cannot claim Input Tax Credit

- Cannot collect tax from customers on invoices

- Not valid for interstate sales

📎 Read Blog 24 – GST Composition Scheme — Simplified Tax for Small Businesses

6. Simplifying Compliance with GST Suvidha Centers

GST Suvidha Centers are government-approved service centers that help individuals and small enterprises complete their tax formalities.

They’re ideal for business owners who:

- Don’t have reliable internet access

- Need help filing or registering

- Prefer human assistance over online tools

🏢 Services Provided:

- New GST registration

- Return filing assistance

- e-Way Bill generation

- GST amendments and cancellations

- DSC (Digital Signature) setup

💰 Cost:

Usually ranges from ₹300 to ₹800 per service, depending on complexity.

📍 How to Find One Near You:

Search “GST Suvidha Center near me” or visit gstsuvidhacenters.in.

7. Common Challenges Small Businesses Face with GST

Even with digital systems, small business owners often face real-world obstacles.

⚠️ 1. Lack of Awareness

Many small traders still don’t understand the benefits of GST registration.

👉 Solution: Attend free workshops by the Ministry of MSME or use online GST training videos.

⚠️ 2. Complex Return Filing

Monthly filing can feel intimidating.

👉 Solution: Use Composition Scheme or GSP tools like ClearTax for automation.

⚠️ 3. Poor Internet Access in Rural Areas

👉 Solution: Visit a nearby GST Suvidha Center for manual help.

⚠️ 4. Fear of Penalties

Missing deadlines can cost ₹50–₹100 per day.

👉 Solution: Set reminders and use calendar alerts.

8. Smart Tools and Apps for Small Businesses

Running a business is easier when you use the right tools.

🔧 Top GST Tools You Can Try:

- MyGSTCalculator.com – Calculate GST instantly for free.

- ClearTax – File returns and generate invoices online.

- TallyPrime – GST-ready accounting software.

- Zoho Books – Cloud-based bookkeeping for small firms.

- KDK Express GST – For accountants managing multiple clients.

📲 Mobile Apps for GST:

- GST Portal App (Official)

- ClearTax GST App

- Tally on Mobile

📎 Try MyGSTCalculator — Free GST Calculation Tool

9. How GST Changed the Game for Small Entrepreneurs

Since 2017, the unified tax system has transformed how micro and small businesses operate.

🚀 Before vs After:

| Feature | Before GST | After GST |

|---|---|---|

| Multiple taxes | VAT, Service Tax, Excise | One unified system |

| Different rates across states | Complex | Standardized nationwide |

| Paper-based filing | Manual | Digital |

| Input tax confusion | Hard to track | Seamless with ITC |

| Compliance cost | High | Lower for small traders |

🌱 Impact Highlights:

- Easier market access: Sell anywhere in India.

- Faster logistics: No more check posts and border delays.

- Digital empowerment: Encouraged e-filing and paperless transactions.

FAQs

1. What is the GST turnover limit for small businesses?

If your turnover exceeds ₹40 lakhs (₹20 lakhs for services), registration is mandatory.

2. What is the composition scheme under GST?

It’s a simplified system for small taxpayers with turnover up to ₹1.5 crore, allowing them to pay a fixed tax rate quarterly.

3. How do Suvidha Centers help?

They offer offline assistance for GST registration, filing, and e-Way Bill services — ideal for non-tech users.

4. Can freelancers or small service providers register under GST?

Yes, if their annual income crosses ₹20 lakhs or they provide interstate services.

Conclusion

For small business owners, GST might have started as a compliance headache — but over the years, it has turned into a powerful tool for growth, transparency, and credibility.

By embracing digital filing, using Suvidha Centers when needed, and taking advantage of schemes like the Composition Plan, even the smallest trader can manage taxes efficiently.

The key is awareness — once you understand the basics, GST stops being a burden and becomes an enabler of business success.

So, whether you’re like Neha, the soap maker from Jaipur, or a small retailer in Chennai, remember:

GST isn’t just a tax — it’s your ticket to India’s formal economy.